(not included in SCU, CDA or CE)

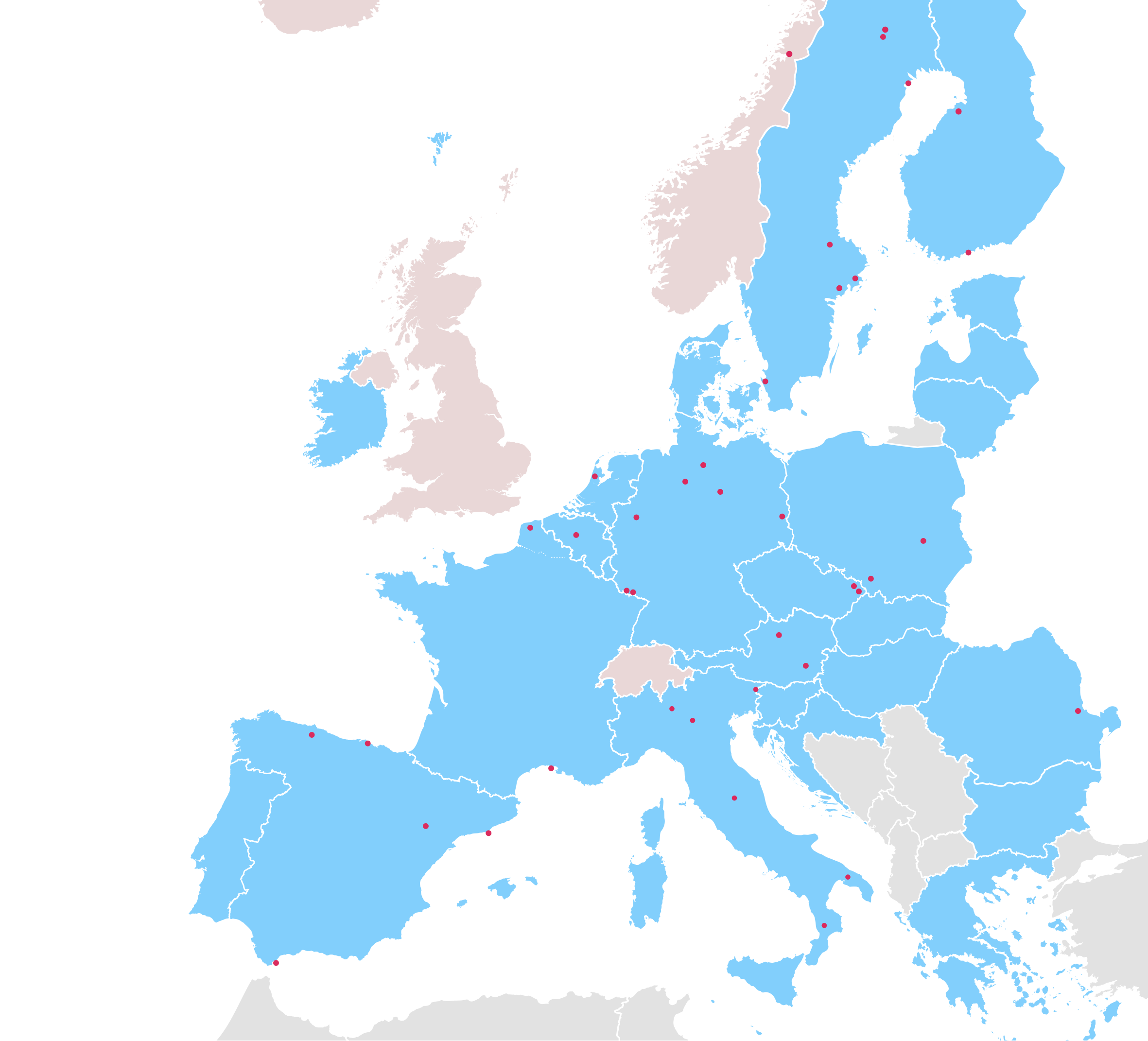

Mo i Rana

Gällivare

Norbotten

Luleå

Raahe

Hofors

Helsinki

Stockholm

Oxelösung

Höganäs

Hamburg

Bremen

IJmuiden

Salzgitter

Eisenhüttenstadt

Duisburg

Gent

Ostrowiec Sw.

Dunkerque

Dabrowa

Gornicza

Ostrava

Trinec

Dillingen

Völklingen

Linz

Leoben-Donawitz

Friuli

Venezia Giulia

Lonato

Del Garda

Dalmine

Umbria

Puglia

Calabria

Asturias

Sestao

Fos-sur-Mer

Zaragoza / Aragón

Galati

Tallinn

Copenhagen

Edinburgh

Dublin

Manchester

Cork

London

Berlin

Amsterdam

Warsaw

Gdansk

Krakow

Prague

Leipzig

Frankfurt

Paris

Munich

Vienna

Bratislava

Budapest

Ljubljana

Venice

Zaragoza

Milan

Athens

Rome

Palermo

Lyon

Marseille

Bordeaux

Valencia

H2 NORWAY (CELSA Nordic) / Mo i Rana

H2 NORWAY (CELSA Nordic) / Mo i Rana

Use of hydrogen as a 100 % fuel source at our Rolling mill.

STARTING YEAR:

Before 2030

HYBRIT (TRANSITION) (SSAB) / Gällivare

HYBRIT (TRANSITION) (SSAB) / Gällivare

HYBRIT (LKAB, SSAB and Vattenfall) demonstration plant for fossil-free hydrogen production and H2 reduced iron sponge production (1.3 million tonnes).

STARTING YEAR:

Before 2030

HYBRIT (TRANSITION) (SSAB) / Raahe

HYBRIT (TRANSITION) (SSAB) / Raahe

Transition, based on HYBRIT technology, from blast furnace to mini-mills, with electric arc furnaces and rolling mills.

STARTING YEAR:

Before 2030

HYBRIT (TRANSITION) (SSAB) / Oxelösung

HYBRIT (TRANSITION) (SSAB) / Oxelösung

Transition, based on HYBRIT technology, from blast furnace to electric arc furnace.

STARTING YEAR:

Before 2030

H2 INITIATIVE (LKAB) / Norbotten

H2 INITIATIVE (LKAB) / Norbotten

IPCEI project for industrial demonstration of hydrogen production, hydrogen-gas heating of pelletizing plants, direct reduction of iron and use of hydrogen in production of fertilizers and REE concentrate

- A new world standard for mining. Through digitization, automation, electrification, new ways of working and carbon dioxide free production, we are setting a new world standard for mining.

- Carbon dioxide-free sponge iron with hydrogen technology. Through the shift from iron ore pellets to carbon dioxide-free sponge iron, we are taking an important step forward in the value chain, increasing the value of our products while at the same time giving our customers direct access to carbon dioxide-free iron for steel production.

- With fossil-free technology, we will extract strategically important rare earth metals and phosphorus for mineral fertilizers from the mines' current residual products.

STARTING YEAR:

Before 2030

THE HYBRIT INITIATIVE (SSAB) / Luleå

THE HYBRIT INITIATIVE (SSAB) / Luleå

THE HYBRIT INITIATIVE - H2 direct reduction pilot plant and hydrogen storage pilot (SSAB) / Luleå

SSAB, LKAB and Vattenfall have started HYBRIT (Hydrogen Breakthrough Ironmaking Technology) to develop a fossil-free value chain for iron and steel production using fossil-free electricity and hydrogen.

Pilot plant for hydrogen production and direct reduction in operation. In June 2021, the three companies were able to showcase the world’s first hydrogen-reduced sponge iron produced at HYBRIT’s pilot plant in Luleå.

This first sponge iron has since been used to produce the first steel made with this breakthrough technology.

Hydrogen storage pilot to be operational in 2022.

STARTING YEAR:

Before 2030

ICOS (OVAKO) / Hofors

ICOS (OVAKO) / Hofors

Improved circularity of steel (ICOS)

Establishing a cost-efficient way of removing Cu from scrap when refining steel

STARTING YEAR:

Before 2030

On-Site EFHS (OVAKO) / Stockholm, Helsinki

On-Site EFHS (OVAKO) / Stockholm, Helsinki

On-site electrolysis for heating steel (On-Site EFHS)

Proving a world-leading cost-efficiency in eliminating CO2 when heating steel for hot-forming. Showing the way for world-leading cost-efficiency in refuelling of fuel cell based long haul trucking. Proving true electricity flexibilty with regulations possible down to 1 second intervals.

STARTING YEAR:

Before 2030

PROBIOSTÅL (Höganäs) / Höganäs

PROBIOSTÅL (Höganäs) / Höganäs

Biomass gasification for reduction of renewable fuels in steel industry

PEP. Challenge (Höganäs) / Höganäs

PEP. Challenge (Höganäs) / Höganäs

Replacement of fossil coal with renewable coal

STARTING YEAR:

Before 2030

CORALIS (Höganäs) / Höganäs

CORALIS (Höganäs) / Höganäs

Waste heat and CO2 for food production in green houses

STARTING YEAR:

Before 2030

DRIBE2 (ArcelorMittal) / Bremen

DRIBE2 (ArcelorMittal) / Bremen

Implement innovative DRI route to reduce carbon footprint

STARTING YEAR:

Before 2030

HH CDA (ArcelorMittal) / Hamburg

HH CDA (ArcelorMittal) / Hamburg

Implement innovative DRI route to reduce carbon footprint

STARTING YEAR:

before 2030

SALCOS (Salzgitter AG) / Salzgitter

SALCOS (Salzgitter AG) / Salzgitter

SALCOS - Salzgitter Low CO2 Steelmaking:

Direct avoidance of CO2 formation in metallurgical processes by the replacement of carbon by (electrolytically produced) hydrogen as reducing agent in iron ore reduction. Use of already established (direct reduction plant (DRP) with natural gas), electric arc furnace (EAF) and novel (hydrogen production and DRP-EAF integration into existing plant) technologies is leading to a gradual reduction of CO2 emissions up to 95% already in 2033. Step I, the replacement of one blast furnace with one direct reduction plant, one electric arc furnace and an electrolyzer, leads to a CO2 reduction of 30 % compared to conventional route in Salzgitter and can start operation already in early 2026 (>2 Mio t CO2/a).

STARTING YEAR:

Before 2030

DRI@Coast (Salzgitter AG) / Salzgitter

DRI@Coast (Salzgitter AG) / Salzgitter

Direct avoidance of CO2 formation in metallurgical processes by the replacement of carbon by (electrolytically produced) hydrogen as reducing agent in iron ore reduction. Use of already established (direct reduction plant (DRP) with natural gas), electric arc furnace (EAF) and novel (hydrogen production and DRP-EAF integration into existing plant) technologies is leading to a gradual reduction of CO2 emissions up to 95%. Stage I, the replacement of one blast furnace with one direct reduction plant, one electric arc furnace and an electrolyzer, leads to a CO2 reduction of 30 % compared to conventional route in Salzgitter and can start operation already in 2026 (>2 Mio t CO2/a).

Unlike the SALCOS project, the DRP is to be built in a coastal location close to offshore wind capacity and proximity to a deep-sea port.

STARTING YEAR:

Before 2030

DRIBE2 (ArcelorMittal) / Eisenhüttenstadt

DRIBE2 (ArcelorMittal) / Eisenhüttenstadt

Implement innovative DRI route to reduce carbon footprint

STARTING YEAR:

Before 2030

H2KM (Thyssenkrupp Steel Europe) / Duisburg

H2KM (Thyssenkrupp Steel Europe) / Duisburg

Stepwise sustainable transformation from conventional Blast Furnace / Basic Oxygen Furnace steelmaking to hydrogen-based Direct Reduction Plant / Electric Arc Furnace steelmaking, with view of at least 30% CO2 emissions reduction by 2025 (compared to 2014) and ultimately achieving climate neutrality by 2045.

STARTING YEAR:

Before 2030

tkH2Steel-1 (Thyssenkrupp Steel Europe) / Duisburg

tkH2Steel-1 (Thyssenkrupp Steel Europe) / Duisburg

1st direct reduction plant with Melting Unit

STARTING YEAR:

Before 2030

tkH2Steel-2 (Thyssenkrupp Steel Europe) / Duisburg

tkH2Steel-2 (Thyssenkrupp Steel Europe) / Duisburg

2nd direct reduction plant with Melting Unit

STARTING YEAR:

Before 2030

tkH2Steel-3 (Thyssenkrupp Steel Europe) / Duisburg

tkH2Steel-3 (Thyssenkrupp Steel Europe) / Duisburg

3rd direct reduction plant with Melting Unit

STARTING YEAR:

Before 2030

tkH2Steel-4 (Thyssenkrupp Steel Europe) / Duisburg

tkH2Steel-4 (Thyssenkrupp Steel Europe) / Duisburg

4th direct reduction plant with Melting Unit

STARTING YEAR:

Before 2030

CARBON2CHEM (Thyssenkrupp Steel Europe) / Duisburg

CARBON2CHEM (Thyssenkrupp Steel Europe) / Duisburg

Conversion of metallurgical gases into valuable base chemicals (Large scale production)

STARTING YEAR:

before 2030

DILCOS (SHS Group) / Dillingen

DILCOS (SHS Group) / Dillingen

Stepwise integration of the new technology / substitution of Blast Furnace

STARTING YEAR:

Before 2030

ENERGY EFFICIENT EAF (Celsa Huta Ostrowiec) / Ostrowiec Sw.

ENERGY EFFICIENT EAF (Celsa Huta Ostrowiec) / Ostrowiec Sw.

Development and implementation of novel structure of EAF

STARTING YEAR:

Before 2030

PSWD (Celsa Huta Ostrowiec) / Ostrowiec Sw.

PSWD (Celsa Huta Ostrowiec) / Ostrowiec Sw.

Project oriented on postscrap organic waste depolymerization toward production or recycled naptha for chemical synthesis

STARTING YEAR:

Before 2030

RENEWABLE ENERGY (Celsa Huta Ostrowiec) / Ostrowiec Sw.

RENEWABLE ENERGY (Celsa Huta Ostrowiec) / Ostrowiec Sw.

Development of renewable energy installation in form of photovoltaic and wind farms

STARTING YEAR:

Before 2030

GAS INJECTION (ArcelorMittal) / Dabrowa Gornicza

GAS INJECTION (ArcelorMittal) / Dabrowa Gornicza

Implement innovative DRI and EAF route to reduce carbon footprint

STARTING YEAR:

Before 2030

HyFurnace (Liberty Steel Group) / Ostrava

HyFurnace (Liberty Steel Group) / Ostrava

Replacement of the four existing tandem furnaces with two hybrid furnaces which will allow the facility to vary the mix of liquid metal and steel scrap used in the steel making process.

STARTING YEAR:

Before 2030

GREENWERK (Trinecke zelezarny, a.s.) / Trinec

GREENWERK (Trinecke zelezarny, a.s.) / Trinec

Partial transformation of steel production towards a scrap-based EAF route with a significant decrease in fossil fuel use, energy and emission intensity, while maintaining quality.

STARTING YEAR:

-

GREENTEC STEEL (voestalpine) / Linz / Leoben-Donawitz

GREENTEC STEEL (voestalpine) / Linz / Leoben-Donawitz

Combination of Electric Arc Furnaces (EAF), Blast Furnaces /Basic Oxygen Furnaces (BF/BOF, “integrated steelmaking”) and direct reduction (DR) technologies

STARTING YEAR:

Before 2030

HYDRA-ITALIA - Linea 4 (RINA-CSM) / Friuli Venezia Giulia

HYDRA-ITALIA - Linea 4 (RINA-CSM) / Friuli Venezia Giulia

Reheating furnace for the subsequent lamination treatments

STARTING YEAR:

Before 2030

H2_4_RHF (CDA) / Lonato Del Garda

H2_4_RHF (CDA) / Lonato Del Garda

Use of H2 for substitution of CH4 in Reheating Furnaces for billets

STARTING YEAR:

Before 2030

DALMINE ZERO EMISSIONS (Dalmine SpA) / Dalmine

DALMINE ZERO EMISSIONS (Dalmine SpA) / Dalmine

Dalmine Zero Emissions project aims to replace natural gas with green hydrogen in the whole finished steel pipes production cycle, from Electric Arc Furnace (EAF) steelmaking to heat treatment processes at Dalmine plant. The target is the decarbonization of the site. Hydrogen will be locally produced by an onsite electrolysis plant powered by renewable electricity

STARTING YEAR:

Before 2030

HYDRA-ITALIA - L3 (RINA-CSM) / Umbria

HYDRA-ITALIA - L3 (RINA-CSM) / Umbria

HYDRA-ITALIA - Linea 3: Electric furnace for melting the pre-reduced product obtained from direct reduction

STARTING YEAR:

before 2030

HYDRA-ITALIA - L2 (RINA-CSM) / Puglia

HYDRA-ITALIA - L2 (RINA-CSM) / Puglia

HYDRA-ITALIA - Linea 2: innovative direct reduction pilot plant powered by hydrogen

STARTING YEAR:

before 2030

HYDRA-ITALIA - L1 (RINA-CSM) / Calabria

HYDRA-ITALIA - L1 (RINA-CSM) / Calabria

HYDRA-ITALIA - Linea 1: integrated infrastructural system for the supply of green hydrogen.

STARTING YEAR:

before 2030

TSN-DRI (Tata Steel) / IJmuiden

TSN-DRI (Tata Steel) / IJmuiden

Combination of Direct Reduction Plant (DRP) and Smelter.

STARTING YEAR:

Before 2030

HISARNA (Tata Steel) / IJmuiden

HISARNA (Tata Steel) / IJmuiden

Innovative Ironmaking technology.

STARTING YEAR:

Before 2030

Gent Smart Carbon (ArcelorMittal) / Gent

Gent Smart Carbon (ArcelorMittal) / Gent

Implement all available KETs to decarbonize BF route

STARTING YEAR:

Before 2030

Gent CDA (ArcelorMittal) / Gent

Gent CDA (ArcelorMittal) / Gent

Implement innovative DRI route to reduce carbon footprint

STARTING YEAR:

Before 2030

Gent CCU (ArcelorMittal) / Gent

Gent CCU (ArcelorMittal) / Gent

Use internal CO2 to produce fuels based on innovative solutions

STARTING YEAR:

Before 2030

Gent CCS (ArcelorMittal) / Gent

Gent CCS (ArcelorMittal) / Gent

Use CCS solutions to sequestrate CO2

STARTING YEAR:

before 2030

DK Smart Carbon (ArcelorMittal) / Dunkerque

DK Smart Carbon (ArcelorMittal) / Dunkerque

Implement all available KETs to decarbonize BF route

STARTING YEAR:

Before 2030

DK CDA (ArcelorMittal) / Dunkerque

DK CDA (ArcelorMittal) / Dunkerque

Implement innovative DRI route to reduce carbon footprint

STARTING YEAR:

Before 2030

DK CCS (ArcelorMittal) / Dunkerque

DK CCS (ArcelorMittal) / Dunkerque

Implement CCS solutions to sequestrate CO2

STARTING YEAR:

before 2030

AST CDA (ArcelorMittal) / Asturias

AST CDA (ArcelorMittal) / Asturias

Implement innovative DRI & EAF route to reduce carbon footprint

STARTING YEAR:

Before 2030

AST CE (ArcelorMittal) / Asturias

AST CE (ArcelorMittal) / Asturias

Use circular economy solutions for decarbonization

STARTING YEAR:

before 2030

EAF Smart Route (ArcelorMittal) / Sestao

EAF Smart Route (ArcelorMittal) / Sestao

Use green electricity, green DRI and fossil free fuel to produce steel in EAF route

STARTING YEAR:

Before 2030

HRSSFSG (Sidenor)

HRSSFSG (Sidenor)

Heat recovery and storage system for steam generation (HRSSFSG):

The main objective of the project is the recovery and storage of residual heat for its usage within the factory processes through the production of steam.

STARTING YEAR:

Before 2030

CIW (Sidenor)

CIW (Sidenor)

Circularity of industrial wastes (CIW):

The main objective is the reuse and valorization of waste derived from industrial processes.

STARTING YEAR:

Before 2030

ROGFWIF (Sidenor)

ROGFWIF (Sidenor)

Replacement of gas furnaces with induction furnaces (ROGFWIF)

Increasing productivity, optimizing consumption and reducing carbon footprint Installation of high-efficiency induction furnaces

STARTING YEAR:

Before 2030

ROSBWEM (Sidenor)

ROSBWEM (Sidenor)

Replacement of steam boilers with electric motors (ROSBWEM)

Reduction of fossil fuel consumption and increase in energy efficiency

STARTING YEAR:

Before 2030

HYBRID BRF (MEGASIDER ZARAGOZA SAU) / Zaragoza / Aragón

HYBRID BRF (MEGASIDER ZARAGOZA SAU) / Zaragoza / Aragón

Improving energy efficiency and CO2 emissions in the rolling mill by means of electrification and substitution of natural gas burners, and digitalization and integration of the furnace managment.

STARTING YEAR:

Before 2030

STEELLOWCARBON (CELSA Group Spain) / Barcelona

STEELLOWCARBON (CELSA Group Spain) / Barcelona

The project aims to minimise the consumption of resources with high carbon footprint.

STARTING YEAR:

Before 2030

CIRCULARSTEEL (CELSA Group Spain) / Barcelona

CIRCULARSTEEL (CELSA Group Spain) / Barcelona

The project aims to close the loop of the Steelmaking by products aplying CIRC principles.

STARTING YEAR:

Before 2030

FEXI (CELSA Group Spain) / Barcelona

FEXI (CELSA Group Spain) / Barcelona

The project aims to minimise the indirect and direct CO2 emisions

STARTING YEAR:

Before 2030

DIPSS (ACERINOX EUROPA) / Los Barrios / Andalucía

DIPSS (ACERINOX EUROPA) / Los Barrios / Andalucía

Decarbonisation (CDA) in the integral production of stainless steel (DIPSS):

Currently there are a number of processes in an integral stainless steel factory in which natural gas (NG) is used as fuel. The project aims to increase gradually the partial replacement of NG by green hydrogen (GH2)

Currently, 0% NG has been replaced by GH2.

By 2025, 12% of NG consumption is expected to be replaced by GH2.

It is intended that, by 2030, a 30% replacement of NG by GH2 will be achieved.

STARTING YEAR:

Before 2030

Fos CDA 1 (ArcelorMittal) / Fos-sur-Mer

Fos CDA 1 (ArcelorMittal) / Fos-sur-Mer

Implement EAF route to reduce carbon footprint

STARTING YEAR:

Before 2030

LSG-DRI (Liberty Steel Group) / Galati

LSG-DRI (Liberty Steel Group) / Galati

Development of DRI plant with intergrated EAF

STARTING YEAR:

Before 2030